This resource has been prepared for educational purposes only. This information is current as of the date of writing and does not constitute legal, investment or other professional advice, which should be obtained prior to relying on anything herein.

______________________________________________________________________________

In Ontario, the Offering Memorandum (OM) Exemption under the National Instrument 45-106 allows companies to raise capital from retail investors without the need for a full prospectus. This exemption has opened doors for businesses to access a broader pool of investors while still providing key disclosures to protect investors. Here’s an in-depth look at how the OM exemption works, its requirements, and what it means for companies and investors alike.

1. What is the Offering Memorandum Exemption?

The OM exemption allows companies to raise funds by selling securities to the public without filing a detailed prospectus, which is traditionally required for public securities offerings. Instead, companies provide an offering memorandum, a simplified disclosure document that includes important information about the business, its management, financials, and risks associated with the investment. The OM exemption is designed to make private investments more accessible to everyday investors, including non-accredited retail investors, who typically have limited access to private market opportunities.

2. Key Features and Requirements of the Offering Memorandum Exemption

The OM exemption balances accessibility with investor protection by imposing specific requirements on both issuers and investors. Here are some of the key aspects:

A. Disclosure Document

The offering memorandum is a detailed disclosure document that must be provided to investors before they commit to purchasing securities. It includes key information on the company’s business model, financial condition, management team, and risk factors. The OM is a simplified alternative to a prospectus, but it still requires significant disclosures, ensuring that investors receive a clear picture of the potential risks and rewards.

B. Eligibility for Use

Any issuer looking to raise capital in Ontario can use the OM exemption, with the exception of certain types of funds and pooled investment vehicles that are not eligible for this exemption. This makes it a versatile tool for startups, small businesses, and companies in industries like real estate, technology, and energy.

C. Investment Limits

The OM exemption is unique because it allows retail investors (non-accredited individuals) to participate. However, to protect these investors, the exemption includes annual investment limits.

Non-Eligible Investors (those who do not meet income or asset requirements): Limited to $10,000 annually.

Eligible Investors (those who meet certain income or asset thresholds): Limited to $30,000 annually.

Eligible Investors with Advice: Can invest up to $100,000 if they receive suitability advice from a registered dealer.

Accredited Investors (who meet higher financial thresholds): No investment limits.

These limits are intended to safeguard retail investors from overexposure to potentially risky private investments.

D. Filing and Compliance Requirements

Issuers must file a copy of the OM with the Ontario Securities Commission (OSC) within 10 days of the first sale of securities. Additionally, they must submit annual financial statements, which are typically reviewed or audited, depending on the size of the offering. Issuers must update investors with any significant changes in the business or financial condition to ensure transparency and keep investors informed about material developments.

E. Resale Restrictions

Securities sold under the OM exemption are subject to resale restrictions, meaning that investors cannot immediately sell or transfer their shares on public markets. These securities are often considered illiquid, which requires investors to have a long-term investment perspective.

3. Benefits of the OM Exemption for Companies

A. Access to a Wider Investor Pool

Unlike other exemptions (such as the Accredited Investor Exemption), the OM exemption allows companies to raise funds from both accredited and non-accredited investors. This broader access is particularly beneficial for smaller companies and startups seeking capital beyond traditional venture capital or angel investors.

B. Cost-Effective Capital Raising

Preparing a full prospectus can be prohibitively expensive and time-consuming, especially for early-stage companies. The OM exemption provides a more cost-effective alternative while still meeting key regulatory requirements to protect investors.

C. Streamlined Disclosure Requirements

While the OM document still requires detailed information, it’s generally simpler and less costly to prepare than a prospectus, allowing companies to focus on growing their business rather than being weighed down by complex regulatory obligations.

4. Considerations and Risks for Investors

For retail investors, the OM exemption offers unique opportunities, but it also comes with specific risks. Here are some considerations:

A. Access to Private Market Investments

The OM exemption allows retail investors to invest in private companies and alternative assets, including real estate, tech startups, and small businesses. This can help diversify a portfolio beyond traditional public market stocks and bonds.

B. Potential for High Returns

Private investments are often high-risk but high-reward. Investors in early-stage or growth-oriented businesses could see substantial returns if the company succeeds, though this is never guaranteed.

C. Higher Risk and Illiquidity

Investments made under the OM exemption tend to be riskier than those in established public companies, as they are often in early-stage or emerging businesses. The illiquid nature of these investments means that investors may not have access to their capital for extended periods.

D. Limited Disclosure Compared to Public Offerings

While the OM provides important information, it does not match the level of disclosure or regulatory scrutiny required for public company offerings. Investors must be prepared to perform their due diligence and assess the company’s financial viability and growth potential independently.

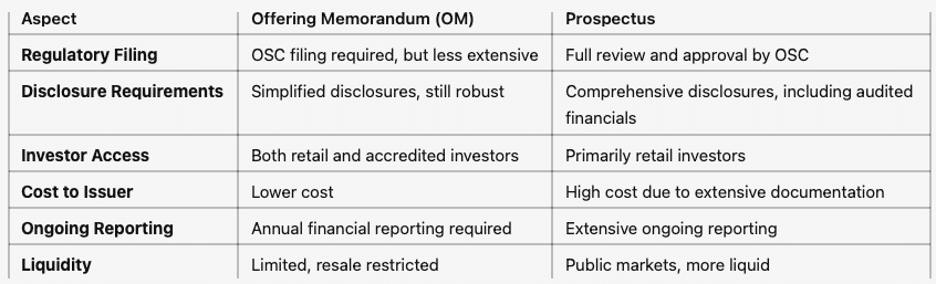

5. The Offering Memorandum vs. Prospectus: Key Differences

To understand the OM exemption’s role, it’s helpful to compare it with a prospectus:

The OM exemption offers a middle ground, providing sufficient disclosure to inform investors while sparing issuers the costs and regulatory burdens associated with a full prospectus.

6. How to Invest Using the Offering Memorandum Exemption

For investors interested in the exempt market through an OM:

A. Work with a Registered Dealer: A registered exempt market dealer (EMD) can guide you through OM investments, ensuring they match your financial goals and risk tolerance.

B. Perform Due Diligence: Review the OM document thoroughly to understand the business, risks, and potential returns. Don’t hesitate to ask questions and clarify any uncertainties with your advisor.

C. Be Aware of Investment Limits: Ensure your investments fall within regulatory limits based on your eligibility status and financial situation.

D. Understand Liquidity Constraints: Be prepared to hold the investment for the long term, as resale options are often limited.

7. Conclusion: The Role of the Offering Memorandum Exemption in Ontario’s Capital Market

The OM exemption in Ontario has democratized access to private investments, allowing companies to raise capital from a broad investor base while providing retail investors the opportunity to diversify into high-potential private markets. For companies, the exemption lowers the barriers to capital raising, particularly for startups and smaller businesses that may struggle with the high costs and complexities of a prospectus.

However, the OM exemption also introduces risks for investors due to lower liquidity and potential for loss. By conducting thorough due diligence and consulting financial advisors, investors can leverage this exemption to diversify their portfolios thoughtfully. As a flexible alternative to traditional public offerings, the OM exemption is a powerful tool, bridging the gap between investors and private companies in Ontario’s dynamic capital markets. Whether you’re an investor or an issuer, understanding the Offering Memorandum exemption can help you make informed decisions and maximize the benefits of Ontario’s exempt market opportunities.